Track live, real-time spot prices and stay ahead of the market.

Download the LIVE GOLD PRICE APP now!

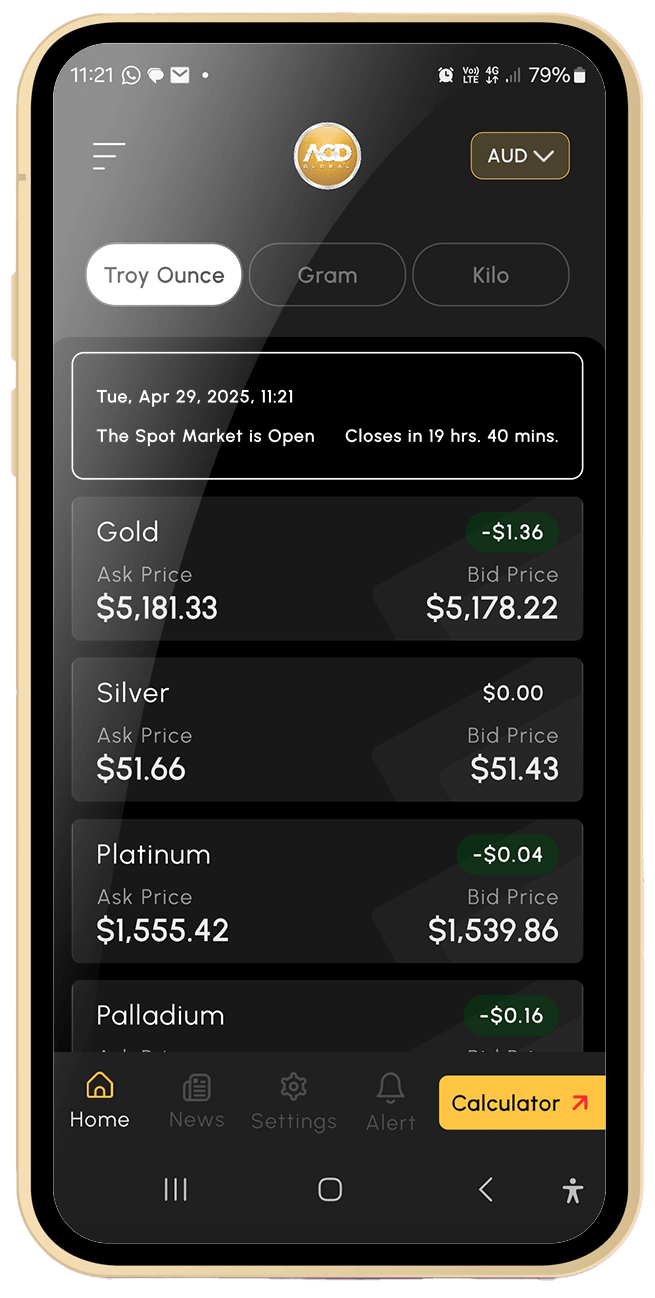

The Spot Market is CLOSED. OPEN in 7 hrs. 37 mins.

Gold

A$ 0.00

Ask Price A$ 7,356.62

Bid Price A$ 7,353.78

Silver

A$ 0.00

Ask Price A$ 120.40

Bid Price A$ 120.19

Platinum

A$ 0.00

Ask Price A$ 3,074.64

Bid Price A$ 3,060.41

Palladium

A$ 0.00

Ask Price A$ 2,348.44

Bid Price A$ 2,291.54

AGD Global provides customers with greater choice and flexibility when trading precious metals. As one of Australia's most respected gold buyers and traders, we offer competitive prices for your unwanted items.

We cater specifically to pawnbrokers, coin shops and second-hand dealers, offering a range of services, including scrap refining, purchasing unwanted jewellery and buying all forms of precious metals.

"We specialise in working with businesses and trade professionals, delivering customised solutions tailored to industry needs. Our services are exclusively designed for registered companies and are not available to the general public."

We offer competitive rates for buying a wide variety of precious metals, including:

The latest Kitco News Weekly Gold Survey showed Wall Street undecided on gold’s near-term direction, while Main Street investors’ recent bullishness returned to the mean after gold’s weak week.

(Kitco News) – Gold traders are closing the book on what has been a frustrating week as the precious metal failed to deliver what many investors expected to be a classic safe-haven pattern.

(Kitco News) – The gold market has been unable to sustain a safe-haven bid even as the war in the Middle East adds to ongoing geopolitical and economic uncertainty.

Copyright © 2026 AGD Global